The 9-Second Trick For Best Bankruptcy Attorney Tulsa

Table of ContentsSome Ideas on Tulsa Ok Bankruptcy Specialist You Should KnowSee This Report about Chapter 7 - Bankruptcy BasicsHow Bankruptcy Lawyer Tulsa can Save You Time, Stress, and Money.Not known Facts About Tulsa Debt Relief AttorneyThe Facts About Bankruptcy Attorney Near Me Tulsa Uncovered

The statistics for the other main kind, Chapter 13, are also worse for pro se filers. Suffice it to state, talk with a legal representative or two near you who's experienced with insolvency law.Numerous lawyers likewise use complimentary appointments or email Q&A s. Take benefit of that. (The non-profit application Upsolve can assist you discover complimentary appointments, sources and lawful help absolutely free.) Ask if insolvency is undoubtedly the right selection for your situation and whether they assume you'll certify. Prior to you pay to file insolvency forms and blemish your credit history record for up to one decade, examine to see if you have any practical choices like debt arrangement or charitable credit rating counseling.

Advertisement Currently that you've determined personal bankruptcy is without a doubt the right training course of activity and you with any luck removed it with an attorney you'll require to get started on the documents. Prior to you dive right into all the official personal bankruptcy kinds, you need to obtain your very own records in order.

Some Known Facts About Bankruptcy Attorney Tulsa.

Later down the line, you'll actually need to prove that by disclosing all type of information regarding your economic events. Here's a standard listing of what you'll need when driving ahead: Identifying files like your driver's permit and Social Security card Income tax return (as much as the past four years) Proof of revenue (pay stubs, W-2s, freelance earnings, income from properties in addition to any type of income from federal government advantages) Bank declarations and/or pension statements Evidence of worth of your properties, such as vehicle and real estate valuation.

You'll want to understand what type of financial obligation you're trying to fix.

You'll want to understand what type of financial obligation you're trying to fix.If your income is too expensive, you have one more alternative: Phase 13. This alternative takes longer to resolve your financial obligations due to the fact that it requires a lasting settlement plan normally 3 to 5 years before some of your staying financial debts are wiped away. The declaring process is also a whole lot a lot more complicated than Chapter 7.

The Ultimate Guide To Tulsa Bankruptcy Consultation

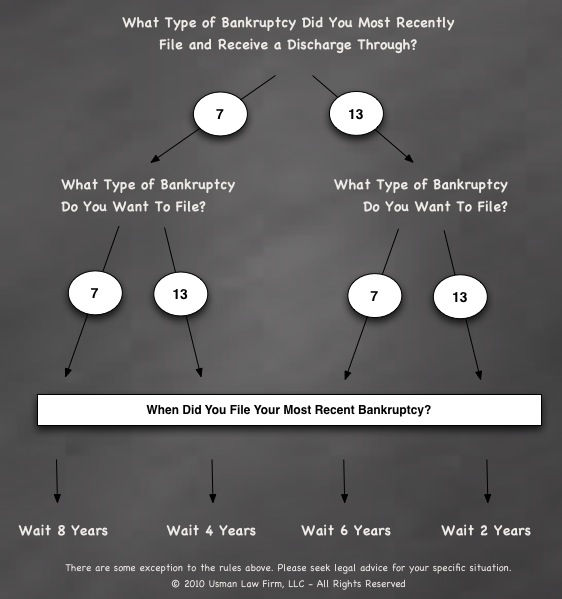

A Chapter 7 bankruptcy stays on your credit score report for 10 years, whereas a Chapter 13 personal bankruptcy falls off after 7. Prior to you submit your bankruptcy kinds, you have to initially finish a required program from a credit history counseling agency that has been accepted by the Department of Justice (with the notable exception of filers in Alabama or North Carolina).

The course can be completed online, in individual or over the phone. You should complete the course within 180 days of filing for insolvency.

Some Of Tulsa Bankruptcy Attorney

Examine that you're submitting with the appropriate one based on where you live. If your copyright has actually relocated within 180 days of loading, you must file in the district where you lived the greater part of that 180-day duration.

You will require to supply a prompt listing of what certifies as an exemption. Exceptions might put on non-luxury, key vehicles; needed home items; and home equity (though these exceptions rules can differ commonly by state). Any type of home outside the listing of exemptions is taken into consideration nonexempt, and if you do not provide any type of listing, after that all your building is considered nonexempt, i.e.

You will require to supply a prompt listing of what certifies as an exemption. Exceptions might put on non-luxury, key vehicles; needed home items; and home equity (though these exceptions rules can differ commonly by state). Any type of home outside the listing of exemptions is taken into consideration nonexempt, and if you do not provide any type of listing, after that all your building is considered nonexempt, i.e.The trustee would not offer your sporting activities car to immediately repay the creditor. Rather, you would certainly pay your creditors that quantity over the training course of your payment strategy. A common misunderstanding with bankruptcy is that once you file, you can stop paying your financial debts. While insolvency can help you clean out numerous of your unsafe financial obligations, such as overdue medical expenses or personal loans, you'll intend to keep paying your regular monthly repayments for safe financial debts if you intend to keep the residential property.

Bankruptcy Law Firm Tulsa Ok for Beginners

If you go to danger of repossession and Tulsa bankruptcy lawyer have actually tired all other financial-relief choices, after that submitting for Phase 13 may delay the foreclosure and assist in saving your home. Inevitably, you will certainly still need the earnings to proceed making future mortgage repayments, in addition to settling any type of late payments throughout your layaway plan.

The audit could postpone any financial debt relief by a number of weeks. That you made it this far in the process is a decent sign at the very least some of your debts are eligible for discharge.

Comments on “Little Known Facts About Chapter 7 Vs Chapter 13 Bankruptcy.”